main street small business tax credit self-employed

Max refund is guaranteed and 100 accurate. Resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million.

Fbc Tax Bookkeeping And Payroll We Make Life Less Taxing

Ad Get between 25K to 6M for Your Business.

. Find Small Business Expenses You May Not Know About And Keep More Of The Money You Earn. Provide the confirmation number received from CDTFA on your Tentative Credit Reservation. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small.

Experience Fast Easy Hassle-Free Funding Process Get Funded As fast As 72 Hours. Ad All Major Tax Situations Are Supported for Free. Applicants will receive a grant amount based on the number of full-time equivalent FTEs employees on staff.

Paying self-employment tax Filing Small Business Taxes Common Small Business Tax Deductions. Free means free and IRS e-file is included. Self-employment tax deductions Sole-proprietors are required to pay self.

If your business had a non-owner employee in 2019 or 2020 that was laid off or furloughed due to COVID-19 or seasonal your business is not a self-employed. So today we are looking at Main Street. 3 things Main Street America can do right now to create business resilience.

You can cover up to 50 of disabled access. Learn What EY Can Do For You. Free 2-Day Shipping wAmazon Prime.

As Congress considers tax reform there are three easy ways they can support the Main Street small-business community. It adds up to a potential total of 28000 in cash back per employee annually. If you provided paid sick leave and paid family and medical leave in 2020 your employer tax credits can be extended through March 31 2021.

During this unprecedented economic time California has taken multiple actions to support small businesses. For tax years beginning in 2010 businesses are allowed to deduct up to 10000 of business start-up costs--thats double the previous 5000 limit. A significant portion of that record tax break is borne by small business and farm people.

1040 Tax Preparation Express. Ad Get between 25K to 6M for Your Business. Your small business is eligible for this credit if you have a total revenue of 1 million or less or have 30 or fewer full-time employees.

Main Street Business Podcast. This credit is a refundable payroll tax credit for qualified wages paid to retain full-time employees from March 13 2020 to December 31 2020. You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with.

The American Rescue Plan extended the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax. We specialize in preparing complex 1040 personal tax returns servicing the Seabrook Clear Lake and League City area. Amending the definition of employee to include the owner of a.

The maximum wage amount. New episodes posted every Thursday. Ad Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes.

The Employee Retention Credit is geared towards small and midsize businesses because you. Besides deductions sole proprietors can also qualify for RD tax credits for small businesses. Additional Support for Business Owners.

The core aim of the ERC is to. Ad Scalable Tax Services and Solutions from EY. 15000 Between 7 and 49 FTEs 20000.

The 2021 Main Street Small Business Tax Credit II will provide COVID19 financial relief to qualified small business employers. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit. The deduction starts to.

Ad Read Customer Reviews Find Best Sellers. Start Your Tax Return Today. MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder.

Available credits are limited so dont delay. A tax deduction for your travel expenses is one of the most underutilized tax deductions by small business owners. If you have individual tax needs.

Your Main Street Small Business Tax Credit will be available on April 1 2021. On June 1 2020 the Louisiana Legislature passed 275M in relief funds for Louisiana small businesses. Ad Calculating your Employee Retention tax Credit.

The 2021 Main Street Small Busines Tax Credit II reservation process is now closed. Authored by Senators Bodi White and Heather Cloud the Main Street Grant. Expanding eligibility for the.

Experience Fast Easy Hassle-Free Funding Process Get Funded As fast As 72 Hours. Provides an assignable 25 tax credit for film video or digital media projects that expend at least 1000000 in eligible production costs. Have to visit both Wall Street and Main Street.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. 10000 6 FTEs or less.

Salary Slip Template 20 Ms Word Excel Pdf Formats Free Payslip Templates Payroll Template Letter Of Employment Ms Word

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

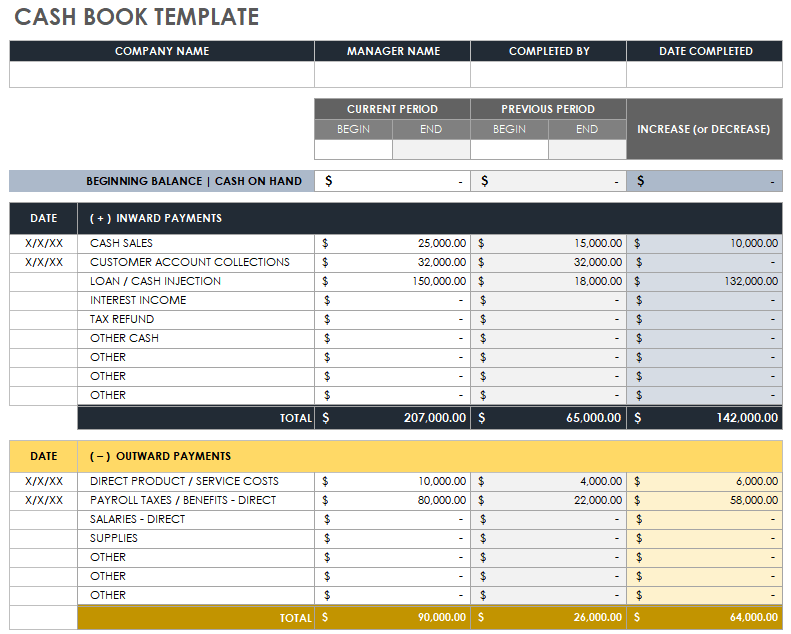

Free Small Business Bookkeeping Templates Smartsheet

Free 21 Sample Business Introduction Letter Templates In Pdf Ms Word Pages Google Docs

Business Tax Deadline In 2022 For Small Businesses

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

How To Write A Perfect Business Plan In 9 Steps

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

8 Best Write Offs For Small Business In Canada Filing Taxes

Contact Wolf Contact Manager Software Download Free Trial

How Taxes Work For Small Business Owners In Canada Arrive

5 Of The Cheapest And Easiest Ways To File Your Taxes Online Online Taxes Tax Refund Tax Preparation

2022 Small Business Trends Statistics Guidant Financial

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Need Your Taxes Done I Have Good Rates And Educate My Clients I Can Process Taxes For Any State Credit Repair Letters Credit Repair Reduce Debt